Flare Is On Fire! Behind the Explosion of FAssets and Development Powered By Ankr

Kevin Dwyer

May 28, 2025

4 min read

Among all of blockchain’s promoted use cases, few can light a candle to its true strength: serving as a decentralized, verifiable hub for shared data. While many chains claim data utility, few are architected from the ground up to make data truly accessible, reliable, and actionable in a decentralized way.

Flare is changing that.

With a purpose-built design focused on delivering trustless access to high-integrity data, Flare has positioned itself as the blockchain for data. Its native protocols, the State Connector and Flare Time Series Oracle (FTSO), enable dApps to consume both on-chain and real-world information without relying on centralized bridges or oracles. This design has set off a surge in developer engagement, making Flare one of the fastest-growing Layer 1 ecosystems in 2025.

And Ankr has the numbers back it up! (More on that below.)

The Power of Partnership: Ankr X Flare

Fueling Flare’s growth is a strong infrastructure partnership with Ankr, which provides Flare developers with seamless, high-speed RPC connectivity. This removes friction for builders, who no longer need to manage their own nodes or rely on unstable connections to interact with the network.

“Flare's collaboration with Ankr helps in providing robust RPC services for our developers, supporting with seamless, high-speed connectivity to build the next generation of decentralized applications.”

– Victor, Developer Relations, Flare Network

With Ankr’s RPC services now supporting Flare’s latest innovations, including cross-chain asset integrations through FAssets, developers are empowered to create data-driven apps with real-time responsiveness, cross-chain functionality, and bulletproof uptime.

What Is Flare? A Data-Optimized Chain To Connect Everything

Flare is a Layer 1 blockchain designed for interoperability and real-world connectivity. It’s EVM-compatible, making it easy for Solidity developers to migrate or build new applications, while offering native access to external data sources – a key unlock for building advanced dApps.

Flare’s standout features include:

- Native interoperability without wrapped tokens or centralized bridges

- Secure access to off-chain and on-chain data via the State Connector and FTSO

- High-performance RPC infrastructure, delivered in partnership with Ankr

- Cross-chain smart contract support, enabling new DeFi use cases across previously disconnected assets

Explosive Developer Momentum: Flare by the Numbers

The Flare ecosystem is in the midst of rapid expansion, marked by a steep rise in both infrastructure engagement and application development. Here are a few standout metrics:

Verified Smart Contracts

The number of verified contracts deployed on Flare continues to climb steadily, a direct signal of increased developer trust and ecosystem maturity.

Stablecoin Liquidity

With the recent inflow of USDT, Flare now supports strong on-chain liquidity for builders, particularly in the DeFi sector.

Network Stability

Flare’s block production remains exceptionally reliable and consistent, even through market volatility, offering developers the performance guarantees they need.

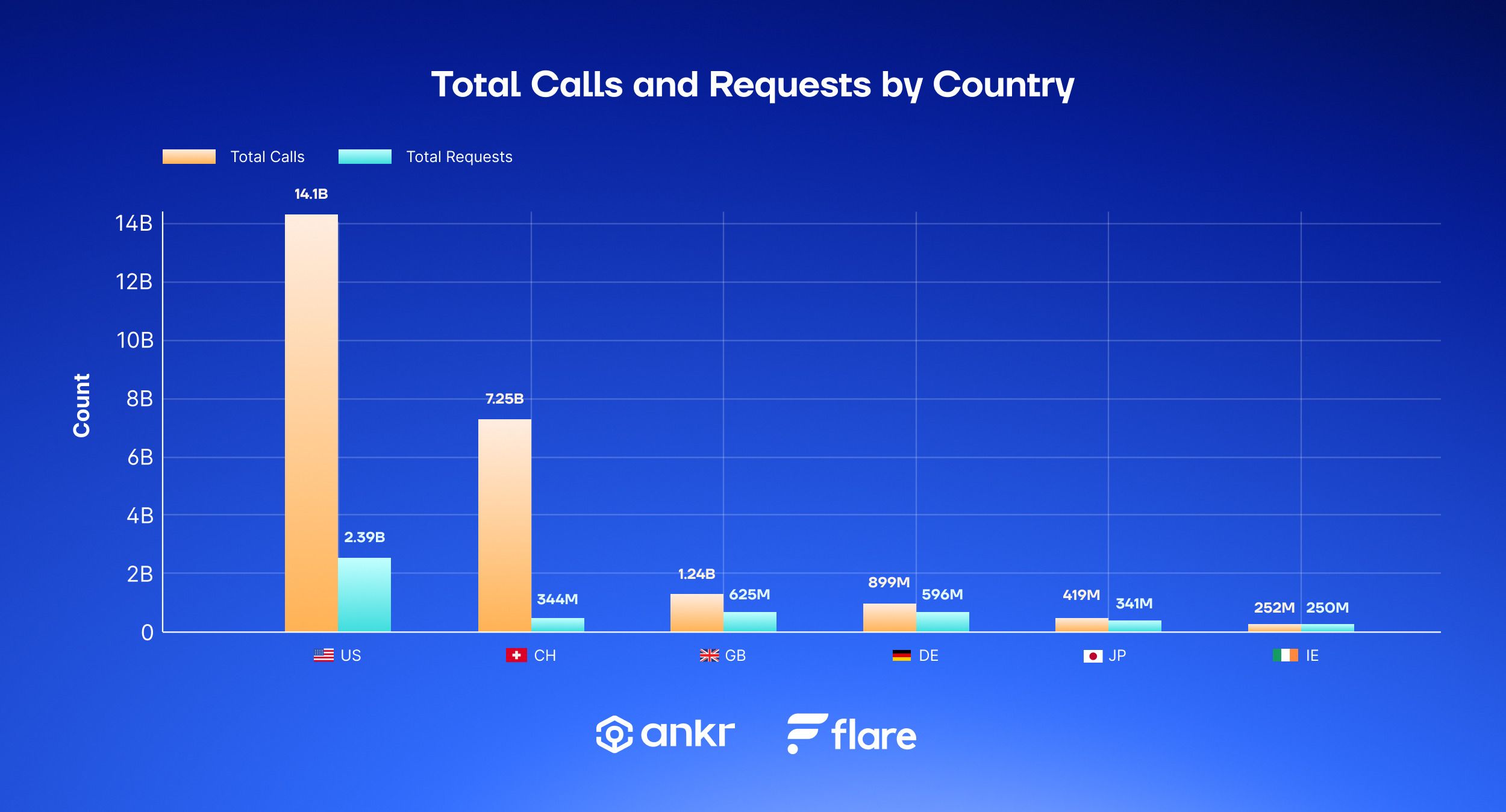

On Ankr, Flare’s developer usage has been growing rapidly over the last 6-months, with a breakdown below of the top regions by usage, along with the type of RPC calls associated with that usage.

These trends point to an ecosystem that is not just growing, but becoming increasingly resilient and attractive to developers.

FAssets: Unlocking DeFi for Non-Smart Contract Tokens

One of Flare’s most groundbreaking contributions to the Web3 ecosystem is FAssets — a protocol designed to bring non-smart contract tokens like XRP, BTC, and DOGE into the world of decentralized finance.

How It Works

FAssets leverage Flare’s native protocols to enable non-custodial minting of synthetic assets. For example:

- Users can mint FXRP by locking XRP on the XRPL

- The assets can then be deployed within Flare’s DeFi ecosystem

Following the v1.1 upgrade, FXRP now supports:

- Unlimited minting capacity

- Improved capital efficiency

- Full composability with Flare’s smart contract suite

What’s Next: FAssets v2

Coming soon, FAssets v2 will introduce a TEE-based wallet protocol (Trusted Execution Environment) to enhance security and performance:

- Faster minting and redemption across chains

- Greater decentralization through hardware-based trustlessness

- A foundation for scalable cross-chain DeFi apps

This is a major step toward bridging Web3’s fragmented liquidity, enabling tokens that were previously excluded from DeFi to now be part of an open, composable ecosystem.

The Bright Future Ahead

Flare is no longer just an emerging Layer 1, it’s rapidly becoming an essential Web3 infrastructure piece. From its deep integration with Ankr’s infrastructure, to its forward-looking innovations like FAssets, to its booming ecosystem metrics, Flare stands out as a blockchain uniquely capable of powering a truly decentralized, connected, and data-driven world.

Join the Conversation on Our Channels!

Twitter | Telegram | Substack | Discord | YouTube | LinkedIn | Reddit | All Links

Similar articles.

Going All In On Cypherpunk: Vitalik Doubles Down On First Principles

Kevin Dwyer

April 29, 2025

The past few years in crypto have been, as always, full of contradictions. While adoption surged among traditional finance and national governments, including the...

Stablecoin Breakout: The $27T Tectonic Shift in Money, Payments, and Power

Kevin Dwyer

May 12, 2025

Last year, stablecoin transaction volume reached $27.6 trillion, blasting past the volumes of Visa and Mastercard put together by 7.7%.

With global transaction volumes now rivaling...